Renters in race for space as demand rises, data shows

Changing patterns in working and commuting, leisure and tourism, have eased rental demand in some city centres across the UK as renters continue to look further afield for larger properties.

Rents are increasing sharply in the wake of greater demand among some renters who are migrating towards properties with more space, indoors and outdoors, as a result of three successive lockdowns over the past 10 months.

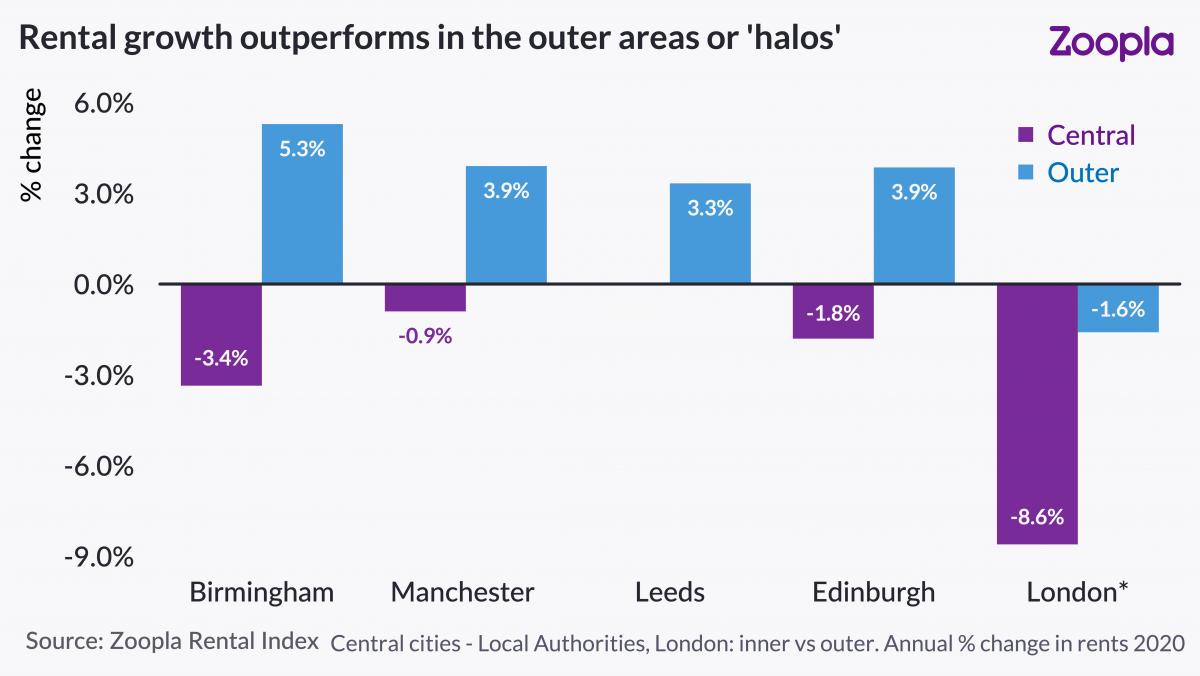

Pockets of demand and rental performance have been redefined across inner and outer cities. For example, rents in central Birmingham fell by 3.4% in the 12 months to December, but in the surrounding boroughs of Bromsgrove, Sandwell and Wolverhampton, rents increased by an average of 5%.

Rents in well-connected towns, such as Rochdale (+8.2%), Hastings (+8%), Southend (+5.8%) and Newport (+5.5%), are also registering strong growth, with demand buoyed by renters freed from the daily commute, and reprioritising their housing needs and location.

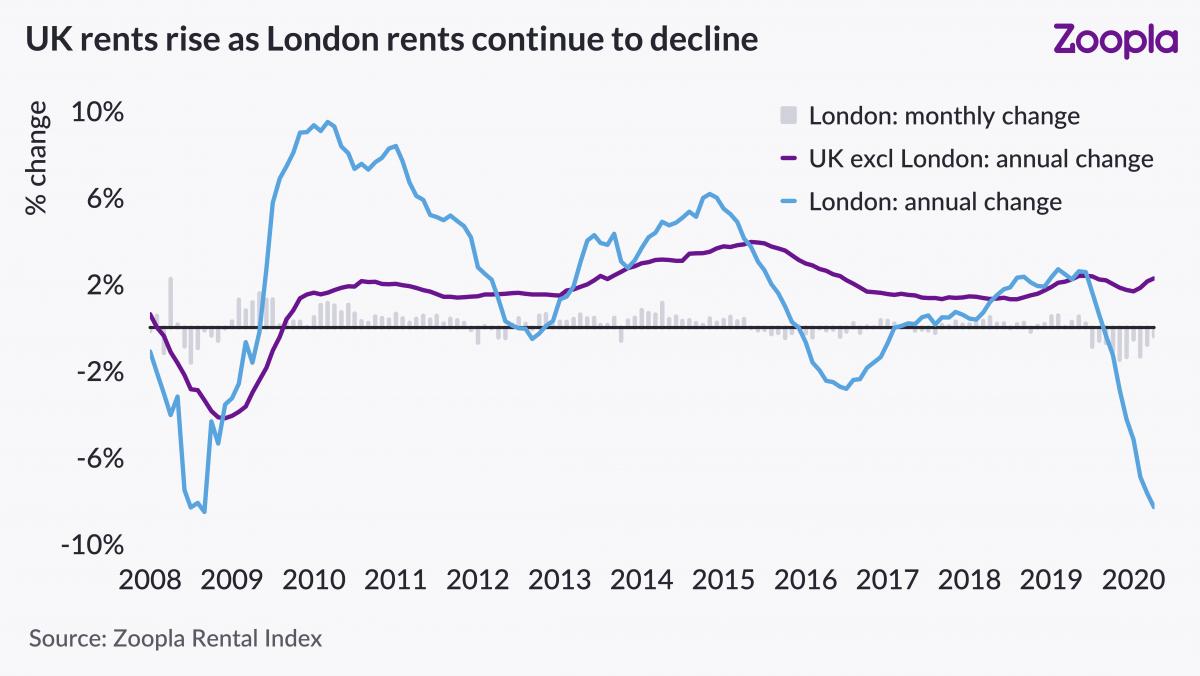

Across the UK as a whole, excluding London, rents have increased by an average of 2.3%, matching pre-Covid levels, and demand is up 21% year on year.

London’s position as a global city means current rental trends have been amplified. Demand in London is down 10% year-on-year in January, resulting from the triple impact of working from home policies, reduced international travel, and a near cessation of tourism.

In addition, Greater London rents have registered the steepest annual fall, at an average of 8.3%, since the global financial crisis.

The fall in overall average rents is being exaggerated by declines in the higher value, more dense rental markets of inner London and Kensington & Chelsea, down 12.3% on average. However, while rents are falling by at least 6% in most inner London boroughs, several outer London boroughs are still showing rental growth, including Havering and Enfield where rents are up 2.6% and 1.1% respectfully.

Furthermore, the downturn in London rents is starting to ease – signalled by the monthly decline in December, which, at -0.4%, was the most modest monthly fall since February 2020.

New supply in London is up 30% year-on-year as short-lets continue to be transitioned into long-lets, and more new build rental supply comes to market, creating more choice for renters and exerting downward pressure on rents.

Higher levels of stock availability are expected to characterise the London market over the course of 2021, pending a post-Covid return to international travel, commuting, employment growth and offices opening at scale.

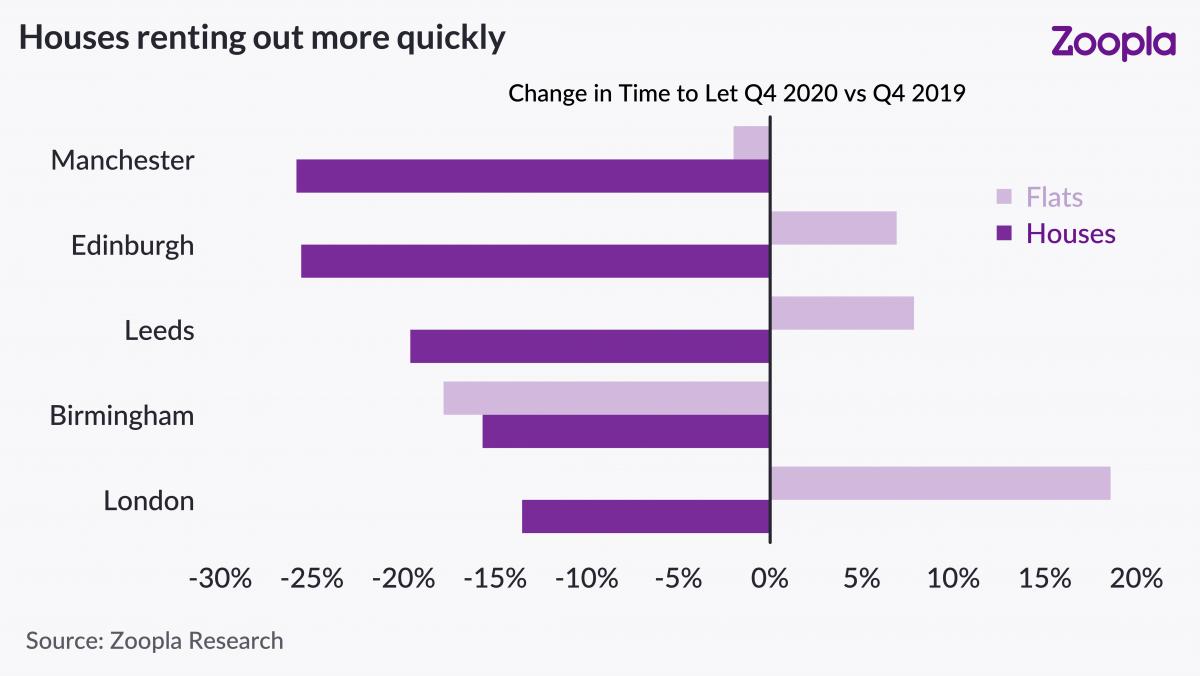

As Covid stimulates ongoing demand for more space, replicating the trend seen in the sales market, houses are now renting out more quickly than a year ago in most key cities, including London, Leeds, Edinburgh, Manchester and Birmingham, while in some cases flats are spending longer on the rental market before being snapped up. From a UK perspective, it’s taking 30% less time to rent out a house and 2% less time to rent out a flat.

In Leeds, it took 20% less time to rent out a house in Q4 2020 compared to the previous year, whereas it’s taking 8% longer to rent out a flat; meanwhile in London, it is now 14% faster to rent out a house, while it is ’taking 19% longer to rent out a flat.

In Manchester, it’s now quicker to rent out a house – 14 days – than a flat at an average of 16 days – a reversal from Q4 2019, when it generally took three days longer to rent out a house than a flat.

As a result of changing demand patterns, in every region of the country, a larger proportion of rental flats than houses are having their asking rents reduced in a bid to attract tenants.

Looking ahead to the rest of the year, the outlook for the rental market depends upon how quickly the roll out of the vaccine can reduce the impact of Covid and, in turn, when business as usual resumes in city centres, with the reopening of shops and offices, leisure and entertainment facilities, and a return to more business activity.

Flexible working is likely to continue, meaning there may be a permanent shift in priorities for some renters. The demand for space is unlikely to diminish any time soon, which will continue to support the family homes rental market, according to Grainne Gilmore, head of research, Zoopla.

Gilmore commented: “Changing working, commuting and tourism patterns were felt very quickly in the central London rental market. Now we are seeing the impact in other city centres, although on a more modest scale.

“Balancing the rental declines in inner cities is the strong rise in rental growth in surrounding ‘halo’ areas and well-connected towns across the UK, reflecting stronger demand in many of these markets among a cohort of renters. Yet it is important to note that most demand among renters living in central cities is within the same area – some renters will have ties to an area through schooling, or non-office based work.

“The search for space among renters is coming across loud and clear from the data however, with houses in major cities now being rented out more quickly than a year ago. In most cases, flats are now taking longer to rent out.”

By Marc da Silva Property Industry Eye Tues 9 Feb 2021